Wake County Property Tax Rate 2024 Neet Application

Wake County Property Tax Rate 2024 Neet Application – While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . Homeowners in multiple towns across Wake County could see their property rate for the 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral .

Wake County Property Tax Rate 2024 Neet Application

Source : www.google.com

EURER #8 Growth Over the Next Decade: Part 2 of Living Up to

Source : issuu.com

Sri Ranga residency Google hotels

Source : www.google.com

EURER #8 Growth Over the Next Decade: Part 2 of Living Up to

Source : issuu.com

Orchard Valley Resort Google hotels

Source : www.google.com

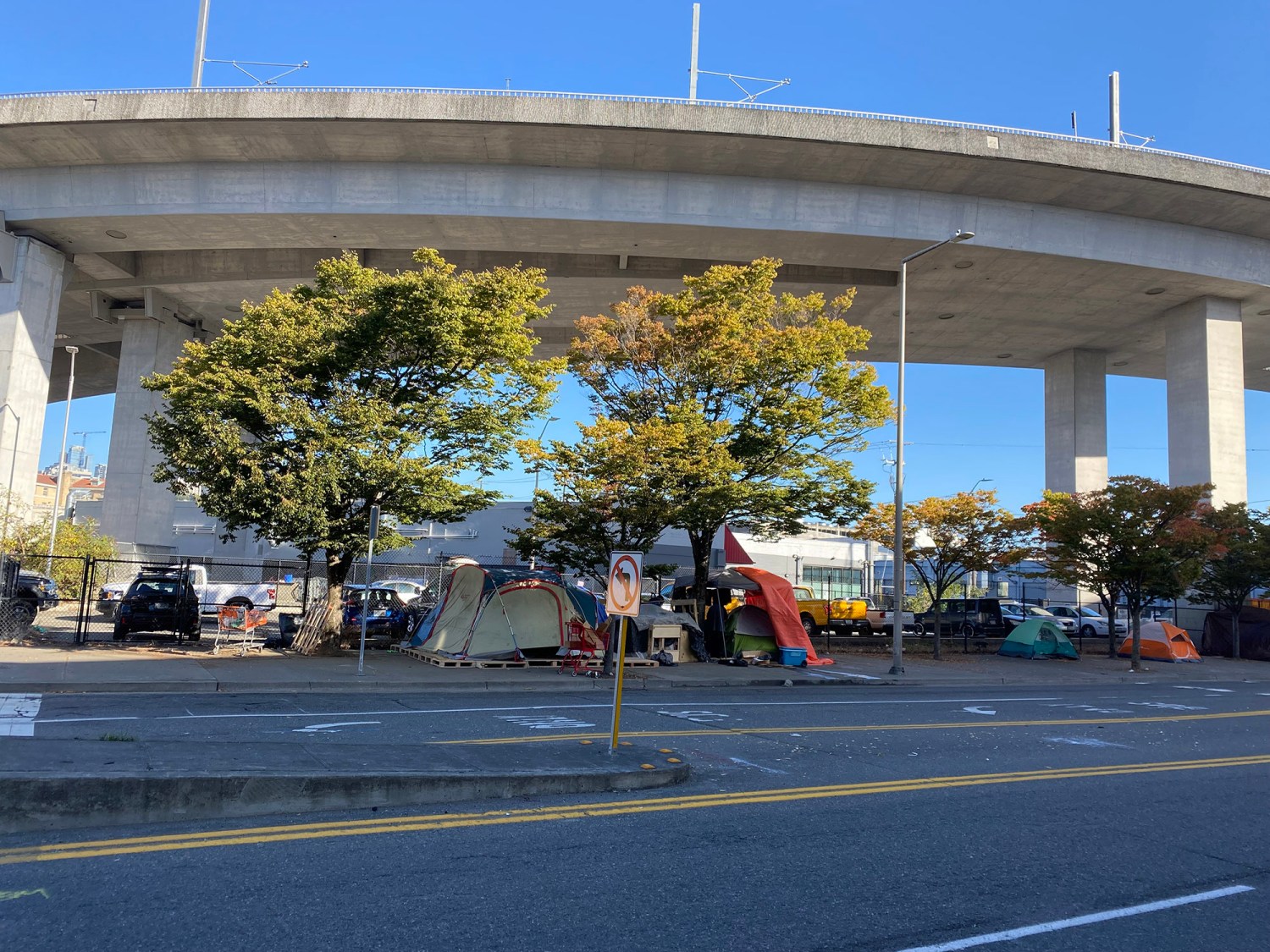

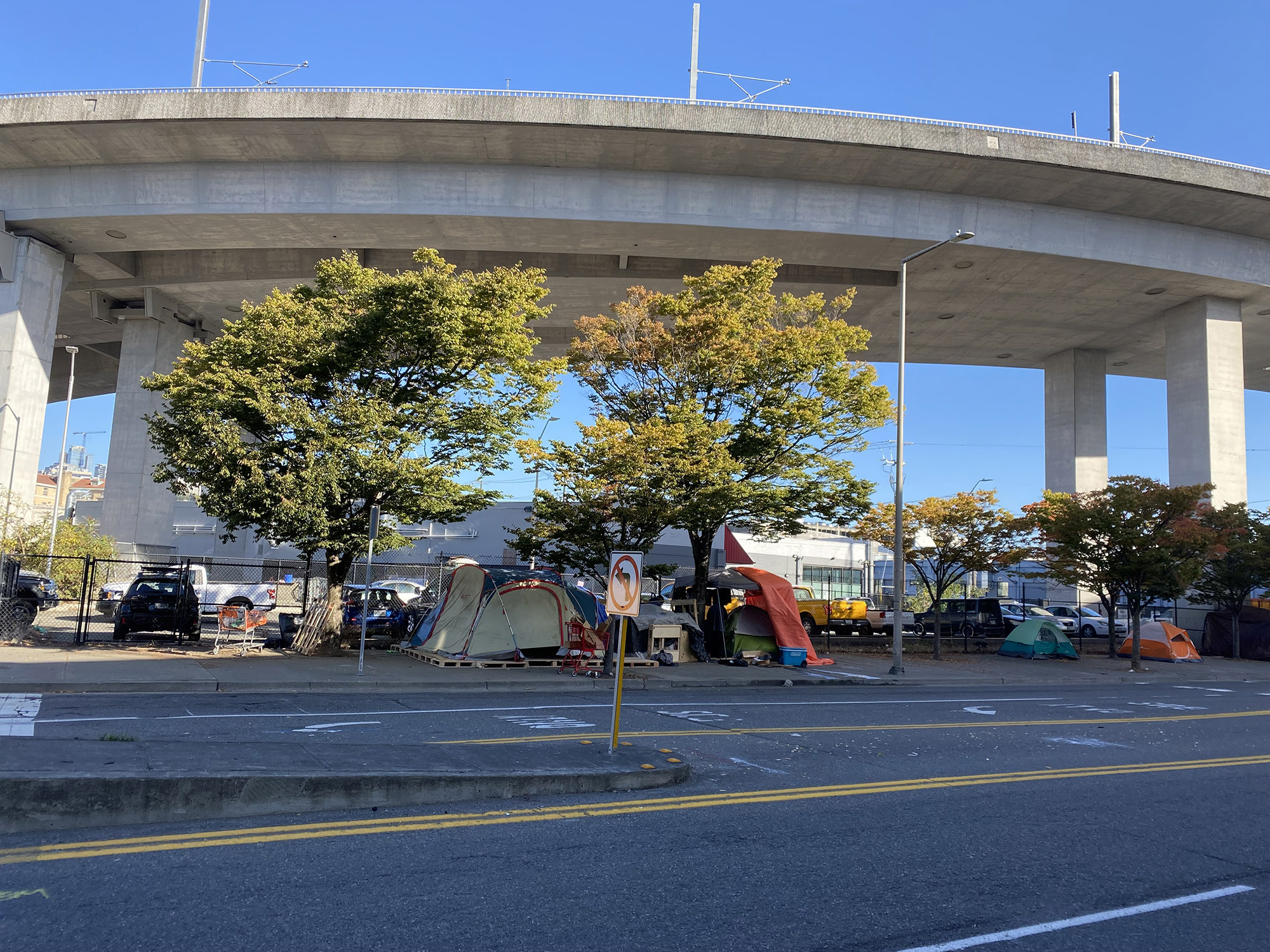

Homelessness in US cities and downtowns | Brookings

Source : www.brookings.edu

News | City of Rolling Fields

Source : www.rollingfieldsky.com

Homelessness in US cities and downtowns | Brookings

Source : www.brookings.edu

Delhi Weather Live News Updates: Winter vacation in Delhi schools

Source : economictimes.indiatimes.com

Top 7 Cyber Security Threats Facing Businesses in 2024

Source : www.localbiznetwork.com

Wake County Property Tax Rate 2024 Neet Application Orchard Valley Resort Google hotels: Call it a “WAKE-UP” call and all over social media, people were upset and flustered to see how much the value of their property has increased since the last valuation in 2020. The average residential . Wake County homeowners’ homes are expected to increase in value compared to 2020, but property taxes are not expected to jump as much as one might expect. Tax rate decrease proposed as new Wake .